THE END OF FINANCIAL YEAR may have come and gone but there is still time for commercial property owners to arrange a tax depreciation schedule. You could claim thousands of dollars in depreciation deductions.

Australian Taxation Office (ATO) legislation permits the owner of any income-producing property to claim depreciation in two ways:

- Capital works deductions

- Depreciation for plant and equipment assets

Capital Works Deductions

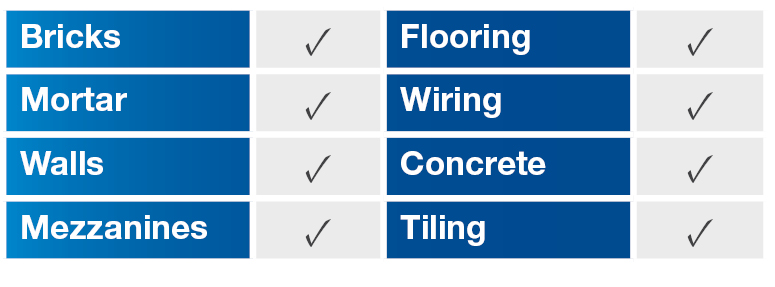

Capital works deductions apply to the structural elements of a building such as:

?These deductions are based on the historical costs of the building. With the exception of traveller accommodation, deductions can only be claimed on commercial buildings if construction commenced after the 20th of July 1982.

Capital works deductions for traveler accommodation can be claimed on buildings in which construction commenced after the 21st of August 1979.

Plant and Equipment Depreciation

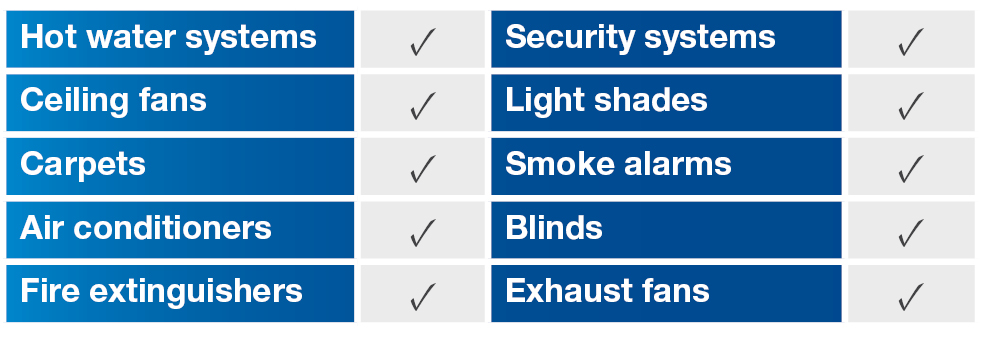

Plant and equipment assets are the mechanical and removable assets contained within an investment property. For commercial investment properties, the types of assets that an owner can claim vary significantly — depending on the building’s use and industry.

Assets that are commonly found in commercial properties include:

Depreciation for plant and equipment assets is calculated dependent on the individual effective life of each asset as set by the ATO.

The effective life of assets can also vary from industry to industry.

Therefore, it is important to consult a specialist Quantity Surveyor. They will ensure your deductions are calculated correctly and you received the maximum depreciation.

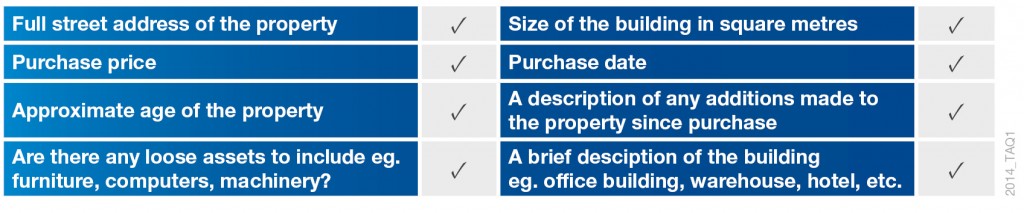

What Information will a Quantity Surveyor need?

Due to the variety of different commercial property types and the assets they contain, a specialist Quantity Surveyor could ask the property owner for the following information when they request a depreciation schedule for their property:

BOTTOM LINE: Commercial property owners should contact a professional, such as BMT Tax Depreciation, to ensure they do not miss out on any depreciation deductions available on their property.

You have a lot of great information here on depreciation. I didn’t know that deductions can only be claimed on for capital works if construction commenced after 1982. I guess that should be a problem, since most buildings were probably constructed after that.