.

SYDNEY HAS traditionally claimed to be the largest office market, with the greatest office space take-up each year.

SYDNEY HAS traditionally claimed to be the largest office market, with the greatest office space take-up each year.

However, more corporate tenants leased space in Melbourne during the second half of last year, then any other capital city. In fact … 110,000 sqm more space than they actually vacated.

As such, the CBD vacancy rate for Melbourne fell to 6.4%; and prime rentals grew by 8.5% in the December quarter – now averaging around $385 psm net.

Space in the pipeline

Furthermore, most of the current and planned developments already have significant pre-commitments in place. Even so, Melbourne’s vacancy rate will soften slightly, as this new space progressively comes on-stream over the next three years.

By contrast, the Perth office market (while improving) will still remain in the doldrums for some time. And with its projected vacancy rate up over 20%, any short-term growth prospects are limited.

Brisbane is only slightly further advanced, with its vacancy rate hovering around 15%.

The Suburban Market

The impact of CBD tenant demand has flowed out into the Melbourne suburban office market – especially within the city fringe.

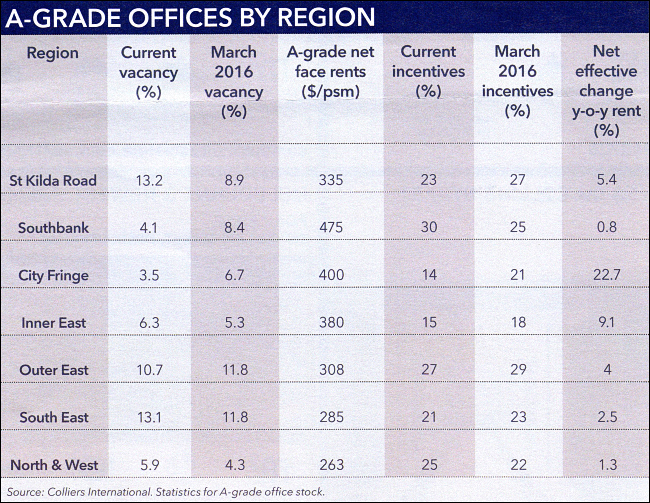

To help you here is a detailed summary …

Casting your eye over the table above, you will notice the city-fringe rentals are actually averaging higher per square metre than CBD net rentals.

Suburban vacancy rates tend to ebb and flow faster than CBD vacancy rates – as tenants quickly realised where they can achieve the best current deal.

Bottom Line: The suburban office market will continue to benefit from the strong demand for space within the Melbourne CBD. This should provide you with some solid growth over the next three years.

Speak Your Mind