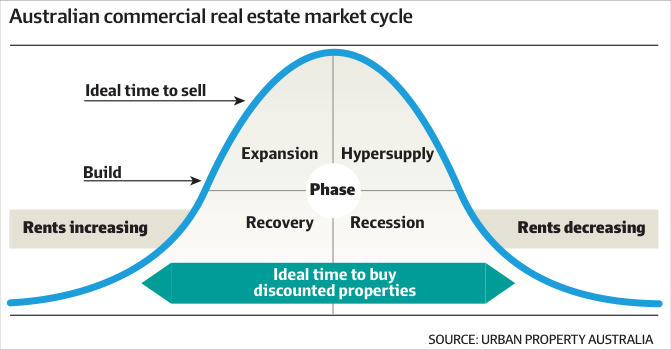

FOR COMMERCIAL PROPERTY investors, understanding the Property Cycle is like having a treasure map – it can guide you in making critical decisions about whether to buy, build or sell.

But what exactly does this Cycle entail? Let’s dive into the four distinct phases, each containing unique opportunities and challenges.

Phase One: Recovery – The Dawn After the Trough

Let’s start with the recovery phase, the hopeful moment when properties begin to claw their way back from the depths of despair.

Excessive construction from the cycle’s previous high has come to a halt, and new developments are few and far between.

Occupancy rates tend to be low, with rental growth either stagnant or on the decline. Yet, there’s a silver lining—interest rates are low, job growth is gaining momentum, and confidence is awakening.

This period can be a golden opportunity to snag properties at bargain prices, setting the stage for future gains.

Phase Two: Expansion – Riding the Wave of Demand

Next, you enter the vibrant expansion phase, where demand surges and vacancy rates plummet.

Construction activity heats up, and competition for commercial assets intensifies, driving prices higher.

As interest rates rise and the economy continues to flourish, smart investors may initiate new developments or upgrade existing properties – harnessing the momentum of a thriving market.

Phase Three: Over-Supply – When Too Much of a Good Thing Isn’t So Good

However, not all that glitters is gold. The over-supply phase creeps in when construction outpaces demand, leading to a surplus of properties and a dip in prices.

With rising interest rates, slowing job growth, and a cooling economy, owners who are considering selling should act swiftly to divest before the cycle shifts again. It’s a crucial moment; timing is everything.

Phase Four: Recession – The Calm Before the Storm

Finally, you arrive at the recession phase, where buyers become scarce and property prices can take a nosedive. Unemployment rises, and confidence wanes, creating a challenging environment for investors.

While this may be a tempting time to buy, caution is paramount, as the recession could linger longer than anticipated.

At first glance, navigating the commercial property cycle seems straightforward: buy in the recession phase and sell during expansion.

Simple, right? Unfortunately, reality often complicates this picture.

Various indicators can send mixed signals, and only in hindsight can you truly recognise where you stood in the cycle. The nuances between the recovery and recession phases can be especially tricky to differentiate.

Spotlight on Asset Classes: Where Do They Stand?

So, where where are you currently in the commercial property cycle? Let’s break it down by asset class.

Office Properties: Currently entrenched in the recession phase, major office landlords are offloading assets and writing down the value of their holdings.

With inflation, rising Interest rates, and geopolitical concerns clouding market sentiment, caution is advised for potential buyers.

The office sector tends to require a longer-term commitment, so a well-thought-out turnaround strategy is a must.

Retail Properties: The retail market appears to be pivoting towards recovery, showing a level of activity that’s noticeably more vibrant than the office sector.

Industrial Properties: The landscape here is more ambiguous and largely dependent on specific market dynamics.

For instance, Sydney’s industrial market is thriving in an expansion phase, buoyed by strong rental growth and limited supply.

Meanwhile, Melbourne’s market is on the cusp of over-supply, despite rising rents, as new developments loom on the horizon.

Navigating the commercial property cycle may not be as straightforward as it seems, but with strategic insight and a keen understanding of market dynamics, investors can position themselves for success.

Bottom Line: The key is to stay informed and be nimble – after all, every phase presents its own set of opportunities waiting to be seized!

Best wishes …

Speak Your Mind