SO, YOU HAVE decided to take the plunge into Commercial property investing. Smart move! But where do you start?

Well, as every serious investor will tell you, having a team of trusted experts by your side is essential for success. These are the people who will guide you and help you navigate the complex world of property investment.

And lucky for you, you get to pick your own dream team. Here are the key players you’ll need. [Read more…]

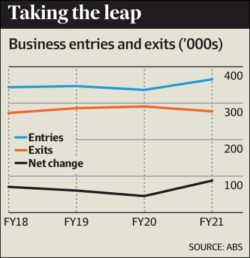

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.