IN REALITY, the Australian economy is showing solid growth in the metropolitan areas. And there is a flow-on effect into most regional cities – the only exceptions being those areas recently struck by drought and bushfires.

While not buoyant (and there may be a short-term pullback from natural disasters) … overall, the economic fundamentals look fine.

Therefore, we need to steer clear from unwittingly talking ourselves into recession. Because, as soon as confidence returns (and it will), consumers will start spending again.

The Key Factors

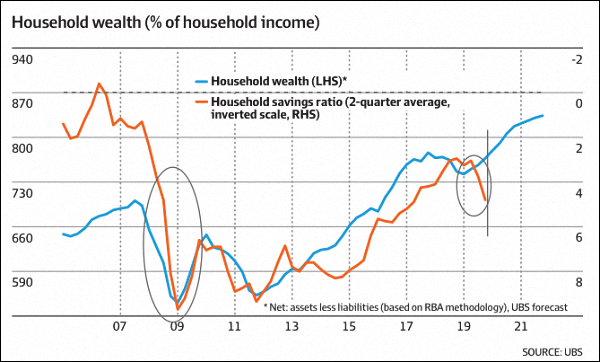

The various rate cuts (both here and overseas) have dramatically boosted share and home values. And that is evidenced in the graph below – depicting the household “wealth effect” currently being experienced.

Even so, Australia has seen low inflation and wage growth; but very strong jobs growth. And as Terry McCrann said in his regular column: “I would argue more for jobs for those out of work than higher wages for those in work.”

As you’ll appreciate, there were a number of speed humps during 2019. Things like Brexit, trade disputes, a Federal election and the devastating fires.

Most of these won’t re-occur during 2020. The main disruption at the moment seems to be the Coronavirus – which could take three or four months to bring under control. At that point, you should see consumer spending pick up significantly.

China Vs the US

Late last year, China and the US agreed on the terms of a “Phase-1” trade deal. And this involves the US reducing some tariffs on Chinese goods AND China committing to purchasing a substantial volume of US agricultural, energy and manufactured goods.

Furthermore, the deal also addresses a range of other issues such as intellectual property protection, technology transfers, currency devaluation, the opening-up of China’s financial sector and dispute resolution.

The general consensus is China’s GDP growth will settle around 6.0% in 2020. However, this could be downgraded slightly, as a result of the Coronavirus outbreak.

Nonetheless, fixed asset investment in the manufacturing sector and foreign trade are likely to experience a mild recovery – while its currency is expected to strengthen gradually, and then stabilise.

What Does This Mean for Commercial Property?

According to CBRE research, the Phase-1 trade deal is expected to …

- provide a short-term boost to economic growth,

- support the gradual recovery of business sentiment, and

- encourage occupiers to commit to expansionary moves.

All of this should provide a mild boost in office demand in 2020. However, the large volume of new supply will continue to exert some pressure on rentals – although Melbourne’s high level of pre-commitment should keep its market in balance.

The main impact of the Coronavirus for Australia will be seen within the tourism and education sectors.

Having said that, most of the Chinese students will have already paid their first-semester Uni fees. And so, if the virus is brought under control in the next few months, the impact on education should be significantly reduced.

Besides, China appears to be relaxing its “great firewall” constraints – to allow students online access to their study material in Australia

While our economy may well take a hit during the first quarter of this year … you should see a strong pickup during mid- to late-2020 – as the funds flowing from the bushfire reconstruction work, start providing a positive impact.

And that’s because demand doesn’t disappear – it is merely deferred. Then, you find it tends to play catch-up.

BottomLine: The demand for well-let commercial property should remain strong for at least the next few years. And once Australia’s productivity and consumer spending begin to pick up, that growth in property values should continue for quite some time.

Speak Your Mind