Yesterday, the Reserve Bank decided to hold the cash rate steady at 4.75%.

Yesterday, the Reserve Bank decided to hold the cash rate steady at 4.75%.

However, it also acknowledged that Australia’s underlying inflation rate will now be running at around 3% for the year — and that’s ignoring volatile items, like petrol and food price spikes.

Economists tend to agree that the high $A has effectively done much of the “heavy lifting” for the RBA.

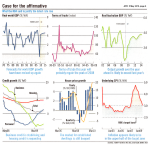

But as these graphs show, the RBA will most likely be forced into a midyear rate rise. With at least one further rise likely, before the end of 2011.

Put simply: Increasing business confidence (confirmed by improved Business Credit figures) means more investment being undertaken by business … which will in turn will put pressure on wage rates.

So far, the RBA has displayed a bias towards pre-emptive action. And there is no reason to suggest it would suddenly change that approach. As such, many people have been left confused by yesterday’s decision.

However, astute Commercial property investors recognise the time to strike is when the “uninformed” are dithering … due to their lack of understanding.