FOR WHAT IT’S WORTH … my view is that there is growing evidence to suggest inflation will not be as sticky as many pundits would have you believe.

Despite a recent surge in residential rentals, Australia’s inflation seems to have reached its peak and is expected to rapidly recede. And that’s evidenced by the June figures just out, showing that inflation has fallen from 7% to 6% per annum, over the last quarter. [Read more…]

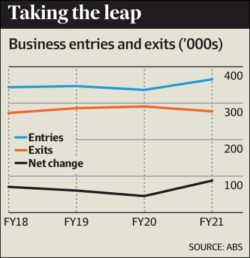

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.