SEVERAL CLIENTS have been asking about how long until things start to get back to “normal”. And what changes investors need to watch for, after we emerged from lockdown.

During times of economic uncertainty, you should focus on the underlying fundamentals driving demand and investment. And these still remain strong.

In my view, you should see a stronger than expected recovery – provided various states don’t unnecessarily delay the steps needed to restart the economy.

You also need to understand that this is not a collapse of the entire financial system, like it was with the GFC.

Instead, Australia is well-placed to emerge from the economic impact of this medical crisis in good shape – because of the rapid response by government and business, plus the impact of the massive stimulus package.

And that means …

Overall, consumers are cashed up – because Australia has spent more on fiscal stimulus than any other advanced economy.

On average, loss of wages has been more than offset by the government contributions. And lockdown has also curbed discretionary spending.

Therefore, consumers have more cash in their bank accounts right now, than they have had for some time. And this should start to translate into a spending boom, as the lockdown rules are relaxed.

As I mentioned in a recent article … in circumstances like these, demand doesn’t disappear – it simply gets deferred.

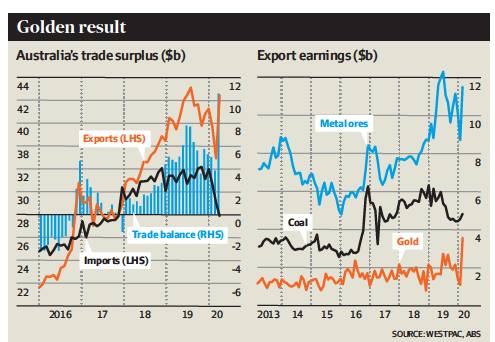

And as you would have read in the media, China still has a huge appetite for our iron ore and coal. Plus, the rest of Asia is now starting to present good export opportunities, which will also help with our recovery.

This graph shows a record trade surplus in March, where it reached $10.6 billion – well above the expected $6.4 billion.

On the Office front

I suspect a significant number of staff members may well ask to continue working from home. At least for a portion of each week – now that they have experienced the benefit of a better work/life balance.

Furthermore, some employers might encourage this – because they have found productivity for many of their team actually improved.

There will always be some who need the comfort of having people around them. But equally, there are others who are more task-orientated (and self-motivated), who relish the freedom of allocating their day by choice.

In other words, they prefer operating in the “results-based” economy … rather than the “time-based” economy.

Demand for Office Space

Naturally, this change begs the question as to whether businesses will need less space going forward?

You see, if 20% of staff prefer to continue on with an out-of-office location … that could well have an impact.

Over the past decade, there has been a strong move towards open-plan office layouts, together with hot-desking.

However, after businesses start to return to traditional office arrangements, you’re likely to find that social distancing requirements will continue for some time.

And that would mean the same office space will now probably contain 20% fewer desks – to accommodate these distancing measures.

Therefore, you are unlikely to see any adverse impact on the demand for office space.

In fact, if the numbers who prefer to continue working remotely are over-estimated … you could well see a surge in demand for space – as businesses feel the need to implement social distancing – until a vaccine is found, and things can return to “normal”.

What about Retailing?

Unfortunately, retailers will continue to do it tough for some time to come.

Yes, there will be an initial surge within the food and cafe sector – as most people are “let out” and want to celebrate their new-found freedom. Although social distancing rules may constrain that.

However, apart from household goods, traditional retailers will find the going tough – with the added challenge of more consumers having tasted (and enjoyed) online purchasing, during the extended lockdown.

The Industrial Scene

Because of the surge in online sales, there’s been a significant boost in demand for warehouse storage and distribution facilities.

As such, you should see the industrial sector continue to flourish in all capital cities over the next five years or so.

Bottom Line: The Federal government has done a commendable job during this difficult time – despite the grandstanding by some premiers.

Australians are an enterprising lot. And provided they’re given the chance … they will respond far quicker than many people think.

Speak Your Mind