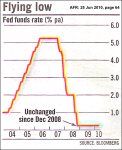

Most people seemed taken by surprise, when the RBA chose to raise the cash rate to 4.75% on Cup Day this week.

However, with Oaks Day being held yesterday, I thought today would be better timing for this post.

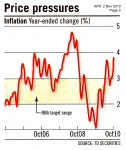

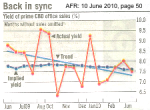

Sure, the September quarter CPI had fallen to within the RBA’s target range. And yes, there is still some uncertainty overseas.However, with industry facing capacity constraints and the mining boom heading towards previous levels … inflation is poised to accelerate during the December quarter, as wages start to rise.

[Read more…]