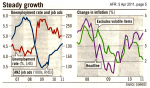

Yesterday, the Reserve Bank left the cash rate unchanged at 4.75%. And these graphs will help to explain their current dilemma.

For the time being, the RBA’s focus is upon “inflation excluding volatile items” — mainly because of the various natural disasters, both here and overseas. [Read more…]