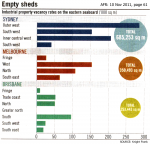

The Queensland economy may be slow to recover from all its natural disasters. But it’s Industrial property sector has been quick out of the blocks.

The Queensland economy may be slow to recover from all its natural disasters. But it’s Industrial property sector has been quick out of the blocks.

The boom in Queensland gas now has Brisbane with the lowest vacancy rate for Industrial property.

Next comes Melbourne — with Sydney well back in 3rd place, according to a recent survey by Knight Frank.

And increasing demand will put further upwards pressure on rentals … thereby, encouraging more developers into the market. [Read more…]

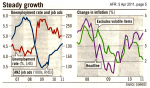

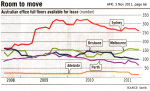

Last week, to the IMF gave the Australian economy a positive report card — with a projected growth of 1.8% for 2011, and 3.3% for the ensuing 12 months.

Last week, to the IMF gave the Australian economy a positive report card — with a projected growth of 1.8% for 2011, and 3.3% for the ensuing 12 months.

Even if the Commercial property you plan to purchase might not be brand-new … you are able to “up value” the various components within the building, to reflect their actual current-day value.

Even if the Commercial property you plan to purchase might not be brand-new … you are able to “up value” the various components within the building, to reflect their actual current-day value.