Over the past few weeks, you have been reading articles about the various Office markets around Australia.

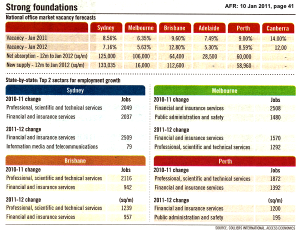

As such, you would now be aware of how each capital City compares, in relation to its … Vacancy rates … Rental levels … and expected Capital growth.

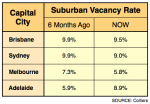

However, most of that commentary has been focused upon CBD Offices. And as a result, people have been enquiring about just how the Suburban Office markets are also likely to perform, over the next few years.

However, most of that commentary has been focused upon CBD Offices. And as a result, people have been enquiring about just how the Suburban Office markets are also likely to perform, over the next few years.

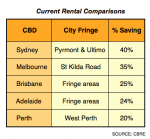

Clearly, a rent differential exists between the City and Suburban Office markets. And obviously, that rental gap will also vary, as you move around Australia. [Read more…]

Wherever you live, you tend to believe (and will happily tell people) that it is undoubtedly the

Wherever you live, you tend to believe (and will happily tell people) that it is undoubtedly the