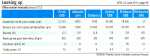

Australia-wide, Office vacancies are falling.

And Melbourne leads the way at 5.5%; with Perth close behind, at 6.6% — due to the rebound in mining activity.

According to the Property Council of Australia, these vacancy levels will reach 4.9% and 6.1% respectively, by January of next year.

According to the Property Council of Australia, these vacancy levels will reach 4.9% and 6.1% respectively, by January of next year.

With zero space coming onto the market in Melbourne, landlords will be well-placed to renegotiate far more attractive deals, as leases fall due for renewal.

Whereas, Brisbane’s current vacancy level of 9.2% is expected to blow out to 9.8% — making it very much a tenants’ market, as far as lease negotiations are concerned.

While rents are rising in most capital cities, selling yields are set to fall as well. This double benefit will be reflected in strong capital growth over the next four years.

Bottom Line: Shrewd investors are currently ranking their preferred Commercial sectors as follows …

- Office (both suburban and CBD)

- Industrial

- Retail

Now is the time for you to start re-balancing your portfolio — and ride the growth wave through to 2018.