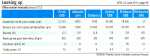

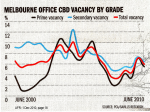

IN LATE JANUARY, the Property Council of Australia released its 6-monthly summary of CBD vacancy rates around Australia.

And not surprisingly, there has been an increase across the board – following a slow return of office work, as a result of COVID. [Read more…]