ONLY RECENTLY, I flagged the emerging opportunity being provided by Industrial property. But I felt it was important for you to understand the underlying reason for that.

In a nutshell, it comes down to our persistently high dollar.

In last weekend’s Financial Review (page 24), Joanna Heath posed the following question:

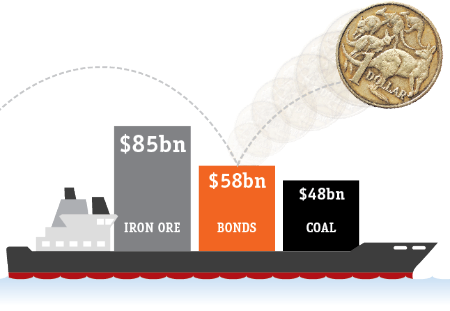

Can you name Australia’s second-largest export?

She went on to point out that it’s not … coal, gas or wheat. Instead, it is actually Australian Commonwealth Bonds!

Central banks from around the world, plus global wealth funds and corporations (even Warren Buffett) have been acquiring our Bonds — to where those purchases now total $58 billion per annum.

As you can appreciate, this means federal borrowing costs are at now a record low. In fact, the IMF is shaping to treat the Australian dollar as an “alternative reserve currency” — a testament to the underlying strength of our economy.

Accordingly, our dollar remains fixed above parity, despite falling commodity prices. That means the RBA’s rate reductions are no longer having the desired effect of lowering our dollar.

And therefore, this lessens the likelihood of further significant rate reductions.

What does this mean for Commercial Property?

Clearly, the high dollar has been (and will continue) adversely affecting our exporters and manufacturers.

However, many of these organisations occupy very large premises — well beyond the reach of most private owners and investors.

On the other hand, it is the importers and distributors who are benefiting from the dollar being as at present high level — which looks set to remain that way for some time.

And this is being evidenced by the present strong demand from owner-occupiers, for smaller Industrial properties — needed to house their flourishing import (and related) businesses.

These properties present themselves as strata-titled units, ranging between $500,000 and $700,000. And they have generally been purchased using personal super funds — and then, leased to those various owners’ business entities.

Bottom Line: Last week, retail activity in the US picked up significantly. And that is also expected for Australia, in the run-up to Christmas.

As consumer sentiment improves, this is the very sector being serviced by many of the smaller warehousing facilities. Therefore, you should see strata-titled Industrial properties come into their own, over the next 3 to 5 years.

Speak Your Mind