.

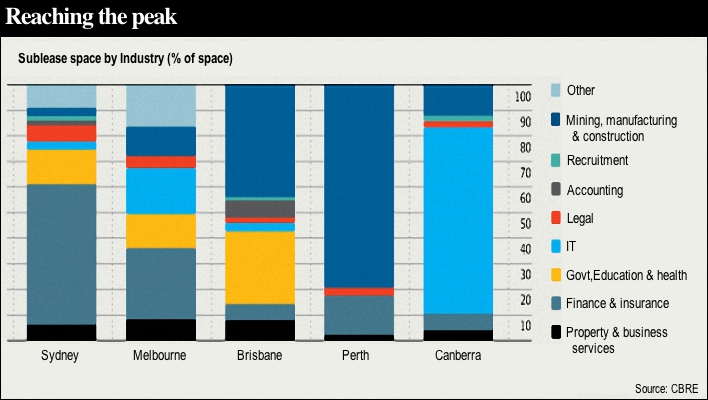

THIS CHART APPEARED as part of a recent article in the Financial Review, by Mercedes Ruhl (30 October, page 41).

The article reassured investors that the anticipated short-term surge in sublease space (within Australia’s CBD Office markets) has simply not eventuated.

“Sublease space spikes at times when the economy is weak and business confidence is low because companies are restructuring and downsizing.”

Furthermore, the article suggests the overall amount of sublease space is expected to fall sharply over the next few months — following the post-election improvement in business confidence.

And of all the capital cities, the CBRE research shows Melbourne has provided the greatest improvement over the past year. [Read more…]

And so once you’ve finally acquired a suitable Commercial property, any ongoing Management will need to make sure that …

And so once you’ve finally acquired a suitable Commercial property, any ongoing Management will need to make sure that …