The Commercial property market is driven mainly by supply and demand — especially Offices.

The Commercial property market is driven mainly by supply and demand — especially Offices.

And therefore, with …

- falling vacancies,

- positive net absorption and

- few new projects in the pipeline …

… this means a looming shortage of Office space around Australia — with rentals poised to rise sharply.

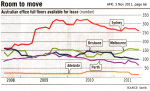

A recent study by Savills shows a 22% decline in available full floors nationally — currently sitting at 591 floors, in September this year.

With the surge in the mining sector, Perth had a 50% fall to 65 available prime floors, over the past two years.

And Brisbane has seen a 32% decline (to 99 floors) over the past 15 months, as its mining sector also regains momentum.

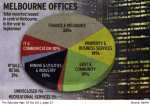

The Melbourne Office vacancy rate has remained consistently low (currently at around 5.3%) due to a more-even balance in its tenancy mix. Plus, most of the new Docklands’ projects proceeded with significant pre-commitments.

The Melbourne Office vacancy rate has remained consistently low (currently at around 5.3%) due to a more-even balance in its tenancy mix. Plus, most of the new Docklands’ projects proceeded with significant pre-commitments.

As such, it has mainly been back-fill space (left by these relocating tenants) which has provided the 56 vacant floors within the Melbourne CBD.

Sydney also enjoyed a decline of over 20% in full floors. However, it still has around 260 prime floors available — being just under half of the total number of floors available nationally.

Bottom Line: With the lack of any major new construction until around 2013-14, vacancy rates will continue to fall. In turn, this will cause sharp increases in both rentals and capital growth — making Commercial property a great performer over the next 5 years.

Speak Your Mind