The underlying fundamentals for Australia are strong.

The underlying fundamentals for Australia are strong.

All that’s needed is a lift in the general confidence level, for our economy to really take off.

Therefore, the trick is … not to be caught by surprise when it does! [Read more…]

Insider Tips to Help You Discover How to Succeed with Commercial Property

>

From a very early age, Chris always sought to discover whatever the RULES might be for each situation – so he could quickly figure out how to master them. And from there, he has continued helping clients achieve their own Commercial Property success.

Read More The underlying fundamentals for Australia are strong.

The underlying fundamentals for Australia are strong.

All that’s needed is a lift in the general confidence level, for our economy to really take off.

Therefore, the trick is … not to be caught by surprise when it does! [Read more…]

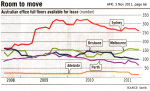

The Commercial property market is driven mainly by supply and demand — especially Offices.

The Commercial property market is driven mainly by supply and demand — especially Offices.

And therefore, with …

… this means a looming shortage of Office space around Australia — with rentals poised to rise sharply. [Read more…]

Last week’s inflation figures were certainly much better than expected.

As such, there had been considerable political pressure placed on the RBA from by the government to cut interest rates this week.

Retailers were virtually pleading with the RBA to do so. Plus, homeowners were also looking for some relief in the run up to Christmas.

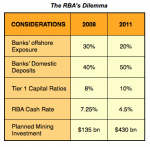

However, this is probably the last interest rate cut by the RBA for quite some time. To understand why, you need to cast your mind back to when the GFC began in 2008.

At the time, business investment was falling.

At the time, business investment was falling.

This is unlikely to occur from now on — because planned mining investment (at $430 billion) is three times greater than in 2008, representing about a third of Australian’s GDP.

And overall, Australia is said to have around $900 billion of business investment in the pipeline.

Furthermore, our main trading partner (China) is now far less dependent upon Western countries for its growth.

In 2008, China’s 12% per annum growth in GDP reflected a 3% to 4% component of exports to the West. While this year’s 9.5% growth in GDP was basically driven by domestic demand — with virtually no exports involved.

Overall, there is said to be around $900 billion of business investment in the pipeline. Add to that the improved stability of Australian banks, with their reduced offshore exposure and improved domestic deposits. Plus, an increase in the Tier 1 capital ratios.

Finally you also need to remember the RBA’s cash rate has now fallen from 7.25% in 2008 to its current level of 4.5% today.

Bottom Line: Apart from the current turmoil in Europe, Australia’s underlying fundamentals are solid. And these augur well for strong growth in Commercial property over the next 5 years.

To reduce interest rates any further would only serve to artificially inflate asset prices — rather than allow the market to grow organically … based upon genuine, sustainable demand.

The Industrial sector was probably the one most harshly affected by the global financial crisis.

Nobody wanted to expand — being prepared to operate in cramped premises, until a clear picture of economic growth emerged.

However, there has been a growing and now, strong tenant demand reported within the main east-coast cities. [Read more…]

FINANCIAL INSTITUTIONS HAVE a range of methods for evaluating commercial properties, but there are some general guidelines that they typically follow.

One of the key numbers that banks focus on is the property’s Net Operating Income (NOI), which is essentially the rental income minus expenses.

WITH EVERY NEGOTIATION, you always need to be thinking on your feet. And here are several simple Tips to help you do just that.

WHEN YOU EMBARK on your journey as a property investor, it can be overwhelming – with a flood of information and diverse opinions. To help simplify the process, here are five essential tips for new (and seasoned) investors.

IT DOES NOT MATTER whether you’re an investor or an owner-occupier, there are several important factors to consider when purchasing a commercial property to ensure you make the right choice.

In a previous article, I shared a handy App to assist you in shortlisting potential properties. If you haven’t already downloaded it, simply click on the HiReturn Filter over on the right, to install it on your tablet or mobile device.

THERE IS A BELIEF among many experts that a surge in the stock market typically precedes a recovery in the commercial property market by about six months. And the start of this year saw equity markets gaining some momentum.

I HAVE BEEN ASKED countless times about the secrets to a successful negotiation. And I want to share with you the key elements to help make your negotiations effective.

But first, just watch this short video to gain a quick understanding of these three essential elements that form the foundation of every negotiation.

If you’re new to investing, you might be wondering if it’s possible to manage your own commercial property. The short answer is “yes”, but only if you know what you’re doing.

It’s important to note that owning a commercial property comes with certain legal responsibilities, particularly when it comes to compliance with Essential Services requirements under current Building Regulations.

Hopefully, you will quickly realise this is not a website for self-promotion.

Rather, everything here has been put together to provide you (as a serious Investor) with the very best insights into what you need to know ... in order for you to succeed with your Commercial property investing.

You see, the deeper your access is to all the key information and the more expert opinions you can learn from ... the more likely your ultimate financial success will be.

That said, you will discover everything you need right here – both readily available, and all in one place.

All the very best ... Chris.

Copyright © 2024 · Genesis Child on Genesis Framework · WordPress · Log in