YOU WILL quickly find that there are two different schools of thought:

YOU WILL quickly find that there are two different schools of thought:

- After much hibernation, Retail property is set to surge again.

- With the high dollar, and growth in online shopping, the Retailing has much catching up to do.

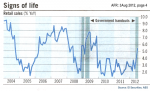

Despite Australia having been mostly sheltered from the global financial crisis, retailers (especially in strip shopping centres) have been doing it rather tough.

Before the GFC, Retail property yields had plummeted. In some cases, as low as 3.5% per annum — with investors clamouring for what they saw as “sexy property”. And they believed values would always increased dramatically. [Read more…]

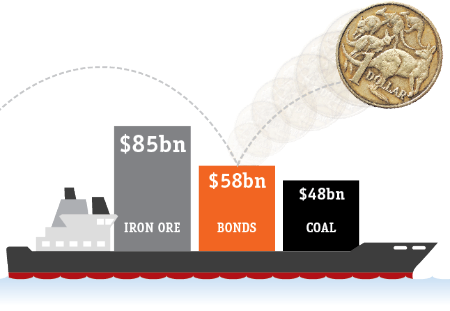

And as the table shows, this is moving closer to Australia; and will bring with it an increase in … specialisation, innovation, productivity and income.

And as the table shows, this is moving closer to Australia; and will bring with it an increase in … specialisation, innovation, productivity and income.