EVERYONE seems to be talking about how people are flocking to the mining states … but does that really give a true reflection of what is occurring?

EVERYONE seems to be talking about how people are flocking to the mining states … but does that really give a true reflection of what is occurring?

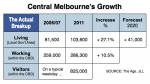

If you take a close look at the statistics, Melbourne is actually leading the country in increased population numbers.

In fact, it has added some 67,000 people during the 12 months to June last year. And Wyndham to the south-west (which includes Werribee) now holds the crown for Australia’s fastest-growing municipality, for the 2nd year running. [Read more…]

Most pundits would point to the recent CPI figures and say “Yes”! And on the surface, an underlying inflation rate of 2.5% per annum is plumb in the middle of the RBA’s stated target zone.

Most pundits would point to the recent CPI figures and say “Yes”! And on the surface, an underlying inflation rate of 2.5% per annum is plumb in the middle of the RBA’s stated target zone.