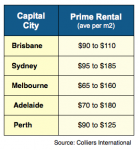

NOT THAT long ago, the Office market as a whole was progressing well … right around Australia.

NOT THAT long ago, the Office market as a whole was progressing well … right around Australia.

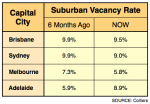

However, following the GFC, each local suburban market has been recovering at a different pace.

Perth rebounded rather dramatically, once the mining sector started to pick up again. And yet it has suddenly plateaued, while mining currently takes a breather. [Read more…]