.

AN ARTICLE in the Weekend Financial Review (Page 39) opened with … “Macquarrie Group, a bellwether for the strength of the office leasing market, is expanding.”

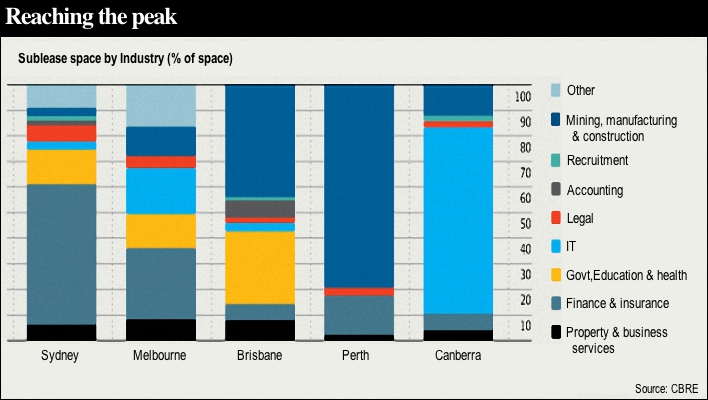

And this clearly accords with a recent report released by BIS Shrapnel, which confirmed the Office recovery would be stronger in “service and trade exposed markets like Sydney and Melbourne, but weaker in the mining-based markets such as Perth and Brisbane.” [Read more…]