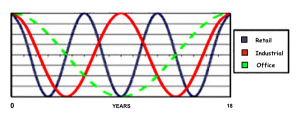

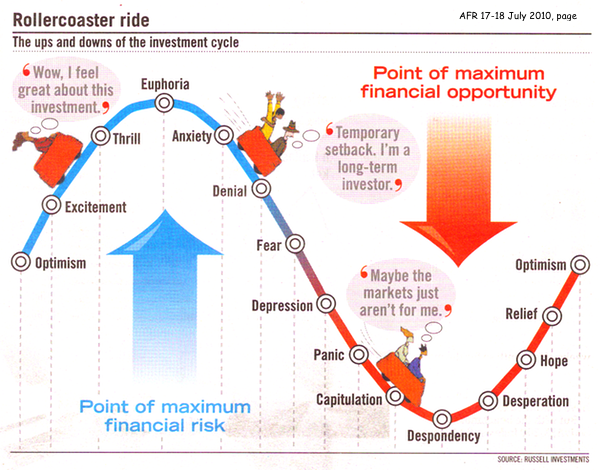

WITH THE Commercial property market now starting to gain some momentum, it might be worthwhile reviewing your current Investment Objectives — simply to ensure they align with your underlying investment strategy.

In formulating that strategy, you may choose to vary the specific order of importance for the following set of Objectives. [Read more…]