An earlier post outlined my view on how the various CBD Office Markets would perform around Australia.

And a report by the ANZ Bank (in yesterday’s Financial Review) pretty much confirmed that previous advice.

Interestingly, their take on the level of vacancies is that it will not reach anything as bad as the 1990s.

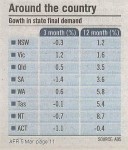

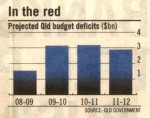

But Perth, Brisbane and Sydney will be the most affected … and slowest to recover.