Overall, Australia has sailed through the Global Financial Crisis more or less unscathed. And from all accounts, Victoria and enjoys the standout economy of all the States.

The Traditional Cycle Has Been Interrupted

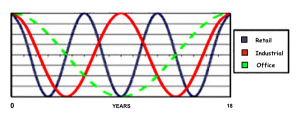

Last week, you explored the traditional cycle for CBD Offices — being 18 years from peak to peak. And over that same period, Retail and Industrial properties tend to go through several cycles.

However, given Australia’s privileged position within the global scene … my view is you are now at the upswing in the cycle for the Office market. In other words, you are already at the halfway point in the traditional Cycle.

[Read more…]