If you’re looking to purchase a Commercial property to occupy yourself, perhaps you should make it a two-step process — by first renting a property within the location you prefer.

If you’re looking to purchase a Commercial property to occupy yourself, perhaps you should make it a two-step process — by first renting a property within the location you prefer.

Finding somewhere to lease is relatively easy, as not everyone wants to sell their commercial property.

Most people own Commercial property for investment — which means you would be able to occupy the space, for as long as you keep paying the rent. Plus, you can then discover whether it is the location you want for your business.

Anyway, you may care to check out a few more tips on buying commercial real estate, as you continue reading. [Read more…]

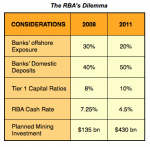

Exactly why have industrial companies around the world been slow to recover? And why did everything look so promising … and then suddenly, seem to grind to a halt?

Exactly why have industrial companies around the world been slow to recover? And why did everything look so promising … and then suddenly, seem to grind to a halt?

For the past few weeks, the world’s media seems to have been dominated by two unfolding dramas:

For the past few weeks, the world’s media seems to have been dominated by two unfolding dramas: And then, we moved to the various aspects Commercial lenders look at as far as Risk is concerned.

And then, we moved to the various aspects Commercial lenders look at as far as Risk is concerned. The most important thing you need to grasp is that there are basically no hard and fast rules about the various factors like … the leverage that is available … costs associated with Commercial loans or … the actual lending criteria most financiers and adopt.

The most important thing you need to grasp is that there are basically no hard and fast rules about the various factors like … the leverage that is available … costs associated with Commercial loans or … the actual lending criteria most financiers and adopt. So, tell me … how many people have you spoken with lately, who are fearful about the European and US debt problems?

So, tell me … how many people have you spoken with lately, who are fearful about the European and US debt problems?