ALL YOU need is a sprinkling of confidence … with an understanding that things are not as bad as you read in many newspapers.

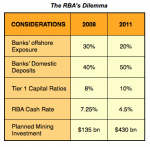

For some time now, I have been trying to explain how the underlying fundamentals for Australia’s economy and Commercial property are strong.

And a recent AFR headline Recruitment boom bucks the trend (9 Dec 2011, page 41) now confirms that our major law firms are “in the midst of a hiring spree”.

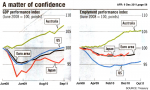

However, if you still need some more convincing of Australia’s well-being, just take a look at these two graphs. [Read more…]

However, if you still need some more convincing of Australia’s well-being, just take a look at these two graphs. [Read more…]

Those experts included … Greg Marr (MD of DTZ), Tony Crabb (Research Head of Savills), together with me (as CEO of Properly Edge Australia).

Those experts included … Greg Marr (MD of DTZ), Tony Crabb (Research Head of Savills), together with me (as CEO of Properly Edge Australia).

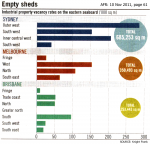

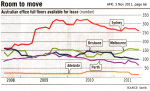

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market.

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market. The underlying fundamentals for Australia are strong.

The underlying fundamentals for Australia are strong.

Several weeks ago, you began learning about how to buy Commercial property using a Private Syndicate.

Several weeks ago, you began learning about how to buy Commercial property using a Private Syndicate. Last week, to the IMF gave the Australian economy a positive report card — with a projected growth of 1.8% for 2011, and 3.3% for the ensuing 12 months.

Last week, to the IMF gave the Australian economy a positive report card — with a projected growth of 1.8% for 2011, and 3.3% for the ensuing 12 months.