The Commercial property market is driven mainly by supply and demand — especially Offices.

The Commercial property market is driven mainly by supply and demand — especially Offices.

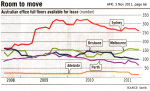

And therefore, with …

- falling vacancies,

- positive net absorption and

- few new projects in the pipeline …

… this means a looming shortage of Office space around Australia — with rentals poised to rise sharply. [Read more…]

Commercial property does require a little more thought than Residential property. But the rewards are solid; and generally, more predictable.

Commercial property does require a little more thought than Residential property. But the rewards are solid; and generally, more predictable.

Several weeks ago, you began learning about how to buy Commercial property using a Private Syndicate.

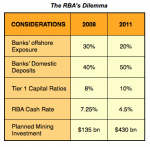

Several weeks ago, you began learning about how to buy Commercial property using a Private Syndicate. Last week, to the IMF gave the Australian economy a positive report card — with a projected growth of 1.8% for 2011, and 3.3% for the ensuing 12 months.

Last week, to the IMF gave the Australian economy a positive report card — with a projected growth of 1.8% for 2011, and 3.3% for the ensuing 12 months. Many investors just simply fall in love with Retail property. And probably, because of familiarity — as it tends to influence so much of our daily lives.

Many investors just simply fall in love with Retail property. And probably, because of familiarity — as it tends to influence so much of our daily lives. Exactly why have industrial companies around the world been slow to recover? And why did everything look so promising … and then suddenly, seem to grind to a halt?

Exactly why have industrial companies around the world been slow to recover? And why did everything look so promising … and then suddenly, seem to grind to a halt?