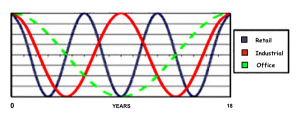

The Industrial sector was probably the one most harshly affected by the global financial crisis.

Nobody wanted to expand — being prepared to operate in cramped premises, until a clear picture of economic growth emerged.

However, there has been a growing and now, strong tenant demand reported within the main east-coast cities. [Read more…]