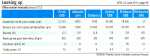

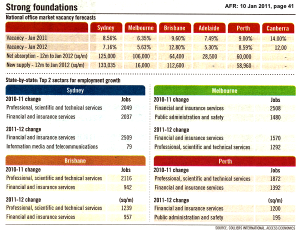

The Commercial property market is driven mainly by supply and demand — especially Offices.

The Commercial property market is driven mainly by supply and demand — especially Offices.

And therefore, with …

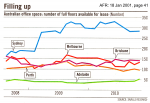

- falling vacancies,

- positive net absorption and

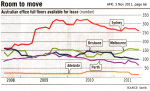

- few new projects in the pipeline …

… this means a looming shortage of Office space around Australia — with rentals poised to rise sharply. [Read more…]